December 2023 News

Simple Ways to Save More in the New Year

Before we know it, the new year will be upon us. Are you ready with some New Year’s Resolutions? Many of our members are eager to save more, in part to offset some of the increase in prices of everyday goods and in part to help ensure that they’re ready for retirement. If you’re hoping to achieve one of those goals, we have a few tips to help you get a solid start to a great resolution.

The rule of 1%

It might not sound like much, but 1% can make a big difference to your retirement savings. If you increase your annual savings contribution by just 1% of your gross annual salary, you aren’t likely to feel it now, but by the time you get to retirement, your account balance will show it. The best part is, it’s true whether you plan to retire in ten years or thirty. For example, if you earn $80,000 per year, your 1% additional contribution means less than $16 per week, but it could result in a tidy sum for your retirement savings. And you’ll barely notice!

Saving for today

It’s no secret that the cost of many regular goods has increased, making our paychecks thin faster. If your resolution is to find ways to cut costs in the new year, here are some things to consider:

- Find free or discounted entertainment. Denver-area museums offer free entry days, and many communities offer free live music. Furthermore, many places offer discounts to students, seniors, first responders, and more—check in advance to see if you qualify for a reduced fee. And follow the Bellco newsletter, where we often run suggestions about low- or no-cost things to do throughout Colorado.

- Shop consignment and thrift stores. These days, it’s trendy to be unique in your style, and you’re bound to find some amazing pieces at great prices at thrift shops. Or check out online platforms like ThredUp, which let you purchase gently worn or even tags-on merchandise for greatly reduced prices; plus, you can sell your own goods to earn money or shopping credits.

- Consider interest-earning checking accounts. While free checking accounts are a good way to avoid fees, consider free checking accounts that earn interest like our Boost Interest Checking that not only let’s you earn up to 4.50% APY for doing many of the things you already do with a checking account, but is also free to use with no monthly fees, or minimum balance requirements. Please speak to a Bellco representative for further information about applicable fees and terms.

Whether your goal is to save more for your golden years or keep your daily spending on track for now, the new year is a good time to start. Just keep your eye on the prize, and you’re likely to find that a small sacrifice now will mean greater reward in the years to come.

Protect Yourself from Holiday Shopping Scams

The holidays are upon us, which, for many people, means lots of shopping—for gifts, for supplies, for party clothes. According to a Gallup poll, 93% of shoppers intend to buy at least some of their holiday needs online this year, and nearly 50% will do most of their shopping on the web. Which, unfortunately, makes for fertile ground for scammers. If you’re among the shoppers who are opting for the convenience of online purchases, you’d do well to be wary of some of the tactics fraudsters are employing.

Buying through online ads

Over the past decade in particular, social media has become a destination for businesses to advertise and offer deals on their goods. As users scroll through their timelines and feeds, they can be enticed by those ads, click them, and potentially try to purchase the item. Unfortunately, many of those ads are easy for scammers to fake—they can make the ads look as though they’re from legitimate, well-known companies, or they can create fake businesses out of whole cloth. By clicking those ads, victims can accidentally open the door to adding malware to their device.

Faking goods for sale

Whether through an ad or through another enticement like an email coupon, scammers can get victims to a site that seems like it’s a trusted retailer—it will have familiar logos, mimic site appearances, and have a URL that’s incredibly close to the real deal. But when shoppers try to buy the product, they wind up being sent a shoddy replica or a completely different product (of poor quality), or they never see the item at all. And on top of that, fraudsters might employ a secondary scam regarding “misplaced” packages from well-known delivery services, further misdirecting victims to other fraudulent sites where they will be in peril of being attacked by malware, having their personal information stolen, or more.

Things to watch out for

Always be wary of clicking links or ads from your email or social media. Here are some signs that what you’re seeing might not be legitimate:

- Prices that seem too good to be true, might just be.

- Poor website design or issues with grammar, punctuation, or spelling.

- A customer service email that’s from Yahoo or Google instead of a corporate account.

- Unusual domains, like “.bargain” instead of “.com.”

- Sites that ask you to download software or enter personal information before you can access a discount.

- A site whose only payment options are wire transfer, money order, or gift card.

While in general, online shopping is safe and convenient, if you choose to buy your holiday goods that way this year, be sure to keep yourself safe by being aware of the dangers tricksters continuously present. And if you do find yourself a victim, contact the Federal Trade Commission as soon as possible. If you believe you are a victim of fraud in relation to your Bellco accounts, please contact Bellco’s Fraud Department at 303-689-7548.

Investment Services with Osaic Institutions

By Osaic Institutions, Inc.

If you haven’t heard, Bellco now provides access to investment products and services through Osaic Institutions, Inc. As a Bellco member, you have convenient access to a variety of investment services located right in your local branch. The Osaic Institutions financial professionals located at Bellco branches are part of your community and are committed to helping you develop personalized financial plans that keep your goals on track.

Whether you are new to investing and don’t know where to start or consider yourself an experienced investor, the Osaic Institutions financial professionals can help you explore your options. Through Osaic Institutions, you have access to a wide range of investment products and services including:

- Annuities

- Mutual Funds

- 401(k) Rollover Options*

- IRAs & Other Retirement Plans

- Life & Long-Term Care Insurance

Schedule your complimentary financial review today! To schedule an appointment with an Osaic Institutions financial professional, visit the Wealth Management section at Bellco.org, stop by any Bellco branch, or call 303-728-3443.

Investment and insurance products and services are offered through Osaic Institutions, Inc., Member FINRA/SIPC. Osaic Institutions and Bellco Credit Union (“Bellco”) are not affiliated. Products and services made available through Osaic Institutions are not insured by the NCUA or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any credit union or credit union affiliate. These products are subject to investment risk, including the possible loss of principal. The past performance of any investment product should not be considered an indication of future results. Insurance products may be purchased from a producer of your choice without affecting your relationship with Bellco. Bellco has contracted with Osaic Institutions to make non-deposit investment products and services available to credit union members.

*Before deciding whether to retain assets in an employer-sponsored plan or roll over to an IRA, an investor should consider various factors including, but not limited to: investment options, fees and expenses, withdrawal penalties, protection from creditors and legal judgments, required minimum distributions, and possession of employer stock.

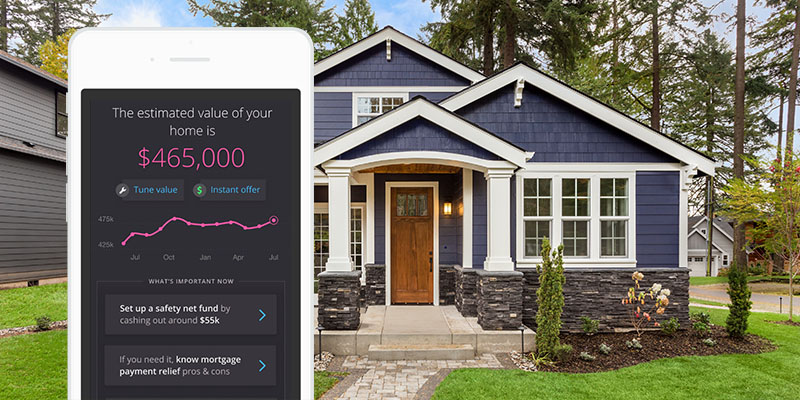

How to Track Your Equity & Build Your Wealth

As a homeowner, you likely know that property values throughout the nation are at an all-time high. That’s why now is a great time to see what sort of wealth you may have accumulated through your home. But how do you find out more about your home’s value and how can that help you build personal wealth?

By entering your home’s address in the free “Homebot” tool through the Bellco Home Loans website, you can get your home’s estimated financial impact on your personal wealth.

Homebot can help you discover:

- The current and historical estimated market value of your home

- Appreciation since you purchased your home

- Net worth/equity in your home

- A breakdown of principal and interest paid

- Tips for how to save on interest payments

- The opportunities you have to sell or purchase properties

- Estimated rental figures for your home (or a room in your home) on services like Airbnb or VRBO

- And much more

Homebot can also give you a better picture if you are looking to refinance. To learn more about and to get started with the Homebot tool, visit us online at BellcoHomeLoans.com/Homebot.

Bellco Home Loans, LLC NMLS# 2085298. Equal Housing Opportunity.

Bellco Home Loans is a joint venture between Bellco Credit Union and Guild Mortgage Company, LLC, an independent mortgage lender that has helped families attain home ownership since 1960. Bellco Home Loans, LLC is an affiliate of Guild Mortgage Company LLC. Guild Mortgage Company LLC; Equal Housing Opportunity, Company NMLS 3274.