April 2025 News

These Remodeling Projects Offer the Best ROI

In today’s dynamic Colorado real estate landscape, smart remodeling isn’t just about aesthetics; it’s about maximizing your return on investment (ROI). While personal preferences matter, focusing on projects with a broader appeal may help to enhance the value of your home.

According to a recent 9News article, minor kitchen and bathroom renovations consistently top the ROI charts. Think fresh paint, updated hardware, new lighting fixtures, and energy-efficient appliances. These updates offer a significant visual impact without the hefty price tag of a complete overhaul. Potential buyers appreciate modern functionality and a move-in ready feel.

Another high-return project is enhancing curb appeal. This includes landscaping, a fresh coat of exterior paint, a new front door, and updated siding. First impressions are crucial, and a well-maintained exterior signals that the interior is likely just as cared for.

Adding or improving outdoor living spaces is also a strong contender, especially in Colorado with its beautiful climate. Consider a well-designed patio, a deck, or even a fire pit area. These additions expand usable living space and cater to the desire for outdoor enjoyment.

Finally, focusing on energy efficiency upgrades can provide a solid ROI. Installing energy-efficient windows, improving insulation, and upgrading HVAC systems not only attract environmentally conscious buyers but also promise lower utility bills.

While major structural changes or highly personalized renovations might enhance your enjoyment, they don’t always translate to the best financial return. By focusing on practical, visually appealing updates that improve functionality and energy efficiency, you can strategically remodel your home for maximum ROI.

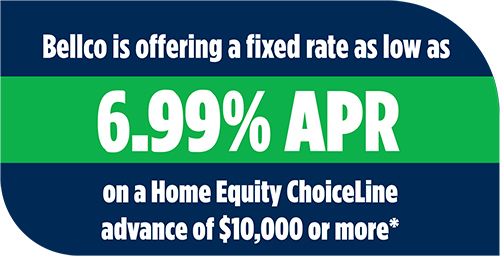

If you’re looking for a great financing options for your remodeling projects, Bellco members can take advantage of this money-saving offer:

HOME EQUITY CHOICELINE OFFER

For a limited time, Bellco is offering a fixed rate as low as 6.99% APR on an advance of $10,000 or more from a new or existing Home Equity ChoiceLine*. For more information about the offer, please visit Bellco.org/ChoiceLine. Bellco is an Equal Housing Opportunity Lender.

*All loans subject to approval. Membership eligibility required.

The Differences Between a Will and a Trust

By LoveMyCreditUnion.org

You may have heard a lot about Wills and Trusts, but do you know the differences? A Will lets you outline your wishes for the distribution of your property and care of dependents after your passing. A Trust can provide greater control over when and how your assets are distributed. Trusts are often used to minimize or avoid probate entirely. (Probate is a legal process to distribute a deceased person’s estate; most people prefer to avoid it because of the cost and time required.)

While Wills and Trusts do have a lot of overlap, there are also several differences between the two. Ultimately, both are ways to say who will receive your assets. They just do it in different ways, and each has its own advantages and disadvantages.

One big difference between the two is in how and when they take effect. Wills don’t go into effect until you pass away, whereas a Trust is effective immediately upon signing and funding it.

It may be easier to think of a Will as a “simple” document. Wills allow you to:

- Name guardians for kids and pets

- Designate where your assets go

- Specify final arrangements

To support your estate planning needs, LoveMyCreditUnion.org has teamed up with with Trust & Will to bring you an easy, affordable, and secure way to create an estate plan. Trust & Will, the leading online estate planning platform, has helped over half a million families in securing their legacies.

Get 30% Off for a Limited Time!

From April 1–30, 2025, Trust & Will is increasing the member discount to 30% off any estate plan. April is Financial Capability Month, which makes it the perfect time to take control of your financial and estate planning needs. Click here to learn more about this exclusive offer.

Don’t Wait for “Perfect” Time to Buy a Home

By Bellco Home Loans

According to a recent Inc.com article, real estate expert, Barbara Corcoran, advises aspiring homeowners not to wait for the “perfect” market. Instead, buy when you can afford the down payment. She points out that housing prices consistently rise, and waiting likely won’t save you money. In fact, waiting for prices to drop can lead to being priced out of the market entirely.

Corcoran’s advice mirrors the wisdom of seasoned equity investors like Warren Buffett, who advocate for long-term investment strategies. Trying to time the market often backfires, which is why it’s recommended to consider the long-term when buying a home. Year-to-year market fluctuations become less significant when you plan to live in a property for many years.

It’s also important to remember that all loans aren’t created equal when it comes to down payments. While down payments may be seen as an obstacle to home ownership, depending on circumstances, there are options for borrowers with little (or even no) down payments.

Therefore, Corcoran’s message is clear: if you plan to buy a house, do it sooner rather than later. Whether prices rise or fall, owning a home provides stability and potential appreciation.

If you are looking to purchase a home and have questions about mortgages, feel free to reach out to Bellco Home Loans for more info at BellcoHomeLoans.com.

Bellco Home Loans is a joint venture between Bellco Credit Union and Guild Mortgage Company, LLC, an independent mortgage lender that has helped families attain home ownership since 1960. Bellco Home Loans, LLC, NMLS #2085298, is an affiliate of Guild Mortgage Company LLC, NMLS #3274; Equal Housing Opportunity Lender. All loans subject to approval.

Save Big on Tax Preparation Services

By LoveMyCreditUnion.org

The last day to file your taxes is April 15. So this year, tackle taxes and come out on top with exclusive, member-only discounts on tax services that make filing easier. You can save 20% on TurboTax®, whether you file yourself or have an expert file for you. Or you can save up to $25 on in-office tax prep services from H&R Block® and have your taxes filed by professionals who can ensure your maximum refund.

TurboTax – Save 20%

- File with confidence that your taxes are done right

- Guaranteed maximum refund

- Tax experts to help or even file for you

H&R Block – Save up to $25

- Biggest refund possible or your money back

- Expert help with or without the office visit

- H&R Block expert within 5 miles of you

Learn more on our Tax Preparation Services page.

Intuit TurboTax is a registered trademark and/or service marks of Intuit Inc. in the United States and other countries. H&R Block and Tax Identity Shield are registered trademarks of HRB Innovations, Inc.able to Bellco members.